Investment Process

We weigh the reward versus the risk for every investment owned, and we monitor the impacts of macroeconomics on investment returns.

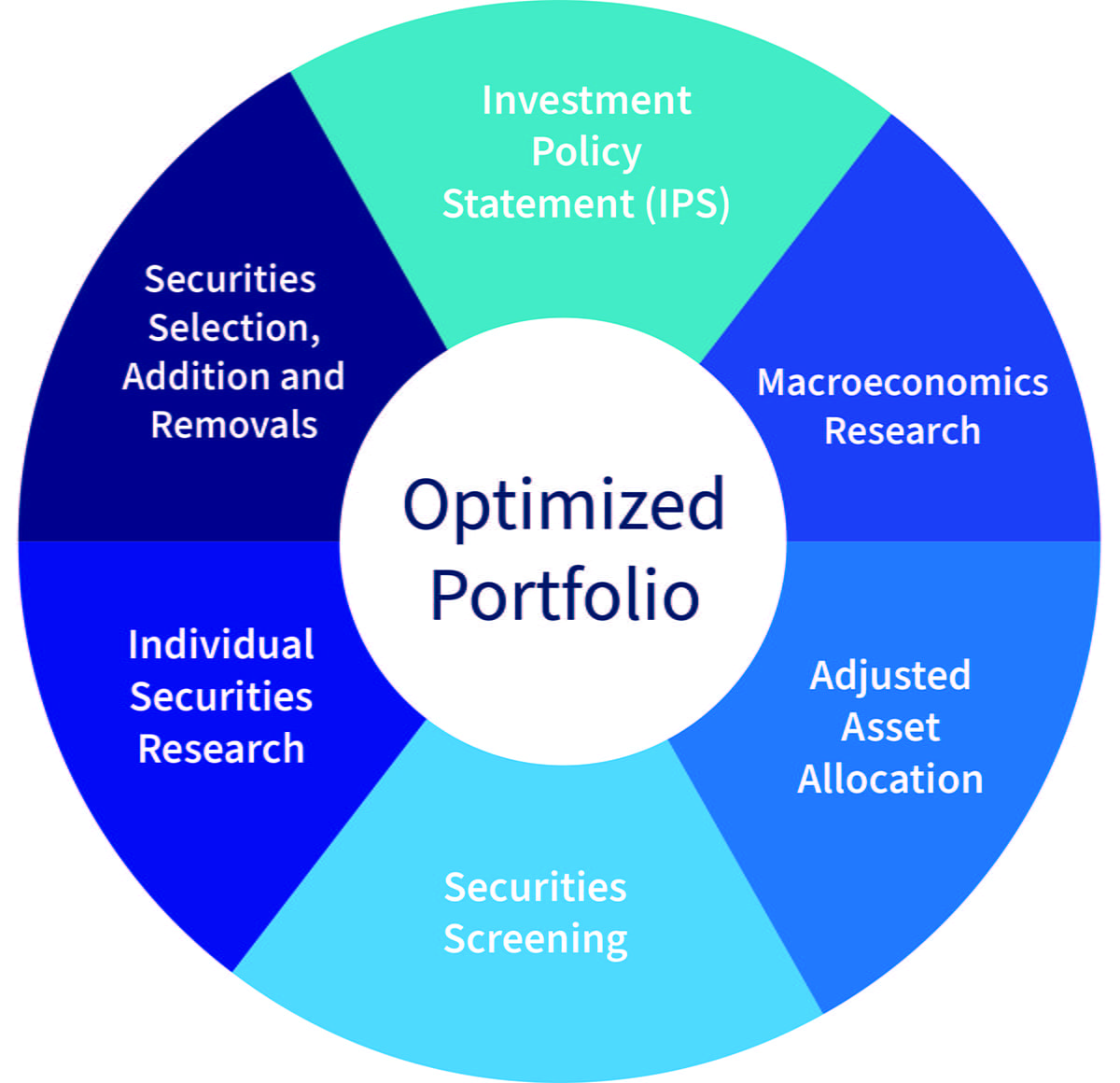

In our investment process, we merge the parameters of your Investment Policy Statement (IPS) with macroeconomic research to determine and update your portfolio asset allocation.

An Overview of Our Investment Process

-

Defines investment objectives and guidelines applicable to your portfolio. It also reflects your objectives and risk tolerance to create a diversified asset mix. The IPS governs the discretionary decisions of the portfolio manager and provides transparent disclosure

-

A top-down look at economies with short- and long-term outlooks impacts allocation of money to cash, bonds and stocks, to sectors and to bond term and credit as well as foreign exposure, all within variances allowed by the IPS.

-

Macroeconomic research leads to tactical adjustments of the strategic allocations as allowed in the IPS.

Simultaneously, we combine securities screening and ranking along with individual security research to select, add and remove securities from your portfolio and apply ESG filters.

-

Quantitative factors analysis of a larger stock universe identifies the best investment opportunities specific for each investment mandate. Value factors include valuation multiples – price/earnings, price/book, price/cash flow. Growth factors include earnings growth, positive earnings revisions, positive earnings surprises and relative strength.

This is a more disciplined approach to security selection.

-

Provides due diligence on buy and sell decisions and identifies risks that may not be captured by quantitative analysis. It also provides continued monitoring for items such as debt covenants, supply chain delays, corporate governance issues and more.

-

Constant review of rankings and individual securities research generates dynamic selection and removal decisions.

-

Is dynamically adjusted and updated for changes needed to asset allocation and securities content.

Constant input from macro research and micro review of securities gives a dynamically adjusted portfolio.

Managing investment risk is just as important as seeking investment return. We’re also aware of the impact of macroeconomics on investment returns.

Whether you’re an individual investor, family or institution, have $1 million or $100 million, we seek to grow and protect your assets.