Institutional Clients

We’ve provided services to institutions for more than 30 years and have developed the skills, knowledge and strategic relationships to meet your particular investment needs.

Most of our clients use a customized, segregated portfolio mandate.

-

We offer specialized investment services for First Nation clients.

We work with the Nation to ensure that the monies you have entrusted to us are managed according to the objectives determined by Chief and council, usually through the use of a Band Council Resolution (BCR).

We can help you preserve funds for future generations and generate long-term growth or provide liquidity and cash flow for today’s needs. We diligently deal with your sensitivity to socially responsible investing issues, whether it be seeking the best investments with emphasis on community values, customer and employee relations, environmental sustainability and human rights, or avoiding nuclear power, weapons manufacturing, tobacco, alcohol or other vice products.

We’re also committed to supporting educational programs for Indigenous Peoples. We are supporters of the Chief Joe Mathias British Columbia Aboriginal Scholarship Fund, and have also funded bursaries through the Indigenous Learning Centre. Past recipients have been from the communities of Pictou Landing First Nation and Sipekne’katik, Cowessess First Nation, Paqtnkek First Nation, Cheam First Nation, Metis Nation of Manitoba, Gitanmaax Reserve B.C., Canim Lake Reserve, Upper Nicola Band and more.

-

Since your investment horizons are set by your bargaining cycle, you may need an absolute return mandate rather than relative returns. As you approach your contract dates, we employ a special tactical service to reduce risk and ensure you have the required liquidity when you need it. We can diligently deal with your sensitivity to socially responsible investing issues, whether it be seeking the best investments with emphasis on community values, customer and employee relations, environmental sustainability and human rights, or avoiding nuclear power, weapons manufacturing, tobacco, alcohol or other vice products.

-

We’ll provide effective risk management and ensure you have the cash flow and liquidity you need in time for regular or special payments. We can diligently deal with your sensitivity to socially responsible investing issues, whether it be seeking the best investments with emphasis on community values, customer and employee relations, environmental sustainability and human rights, or avoiding nuclear power, weapons manufacturing, tobacco, alcohol or other vice products.

-

With our efficient and transparent bond market access, we can manage your cash reserves or operating surpluses. Directly from our office, we can help you roll over your cash via timely use of money market instruments and short-term bonds.

How We Help

-

Security of assets is a key consideration for institutional clients and their stakeholders. Raymond James was established in 1962 and was founded on the enduring values of integrity, long-term thinking, and always putting the needs of our clients first. Today, the firm administers over US$1.3 trillion in client assets worldwide and is the largest independent investment dealer in Canada.

-

We partner with privately owned, independent research firms for non-sell-side, unbiased research:

- BCA Research

- MRB Partners

- Capital Economics

- Bespoke Investment Group

- SIA Charts Inc.

- Factset.com

-

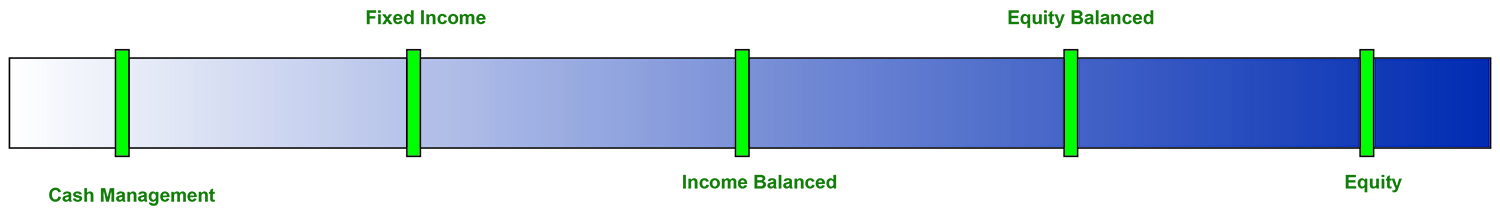

We can help you put your objectives and risk requirements into a formal policy – clearly defining the amount of risk your organization is prepared to take as well as return expectations and boundaries for each asset class to be used. This makes it easier for trustees to report to members and stakeholders in a professional manner and meet their fiduciary responsibilities.

-

On request, we provide seminars and workshops for council and board members and trustees. We can tailor these sessions to suit your needs.

-